Margin in accounting meaning

For example if a product sells for 100 and costs 70 to manufacture its margin. In accounting terms a standard margin is a measure of profitability for a business unaffected by one-time events the random and the unpredictable.

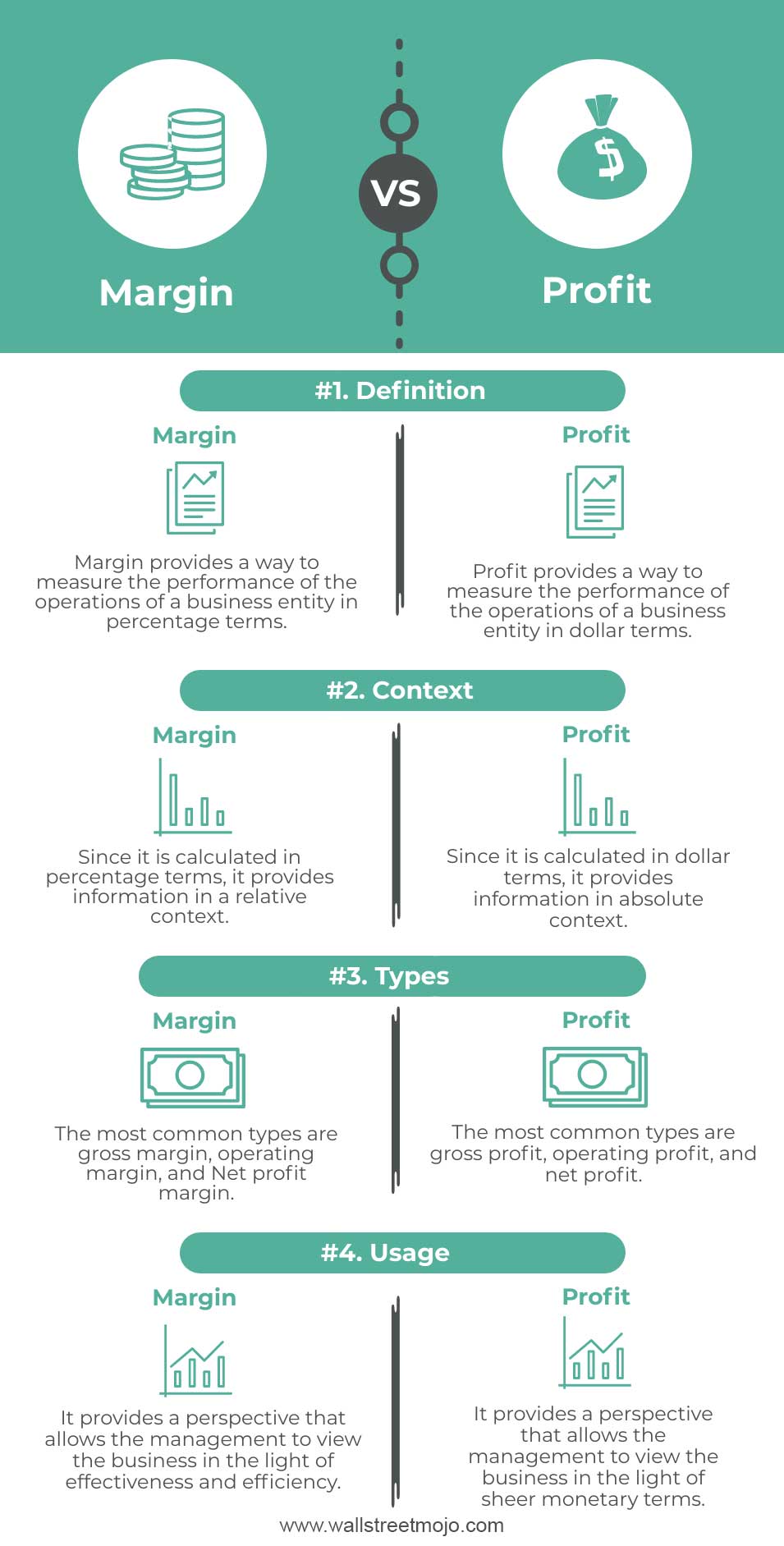

Margin Vs Profit Top 4 Difference With Infographics

In essence it shows the proportion of each dollar of sales that is retained.

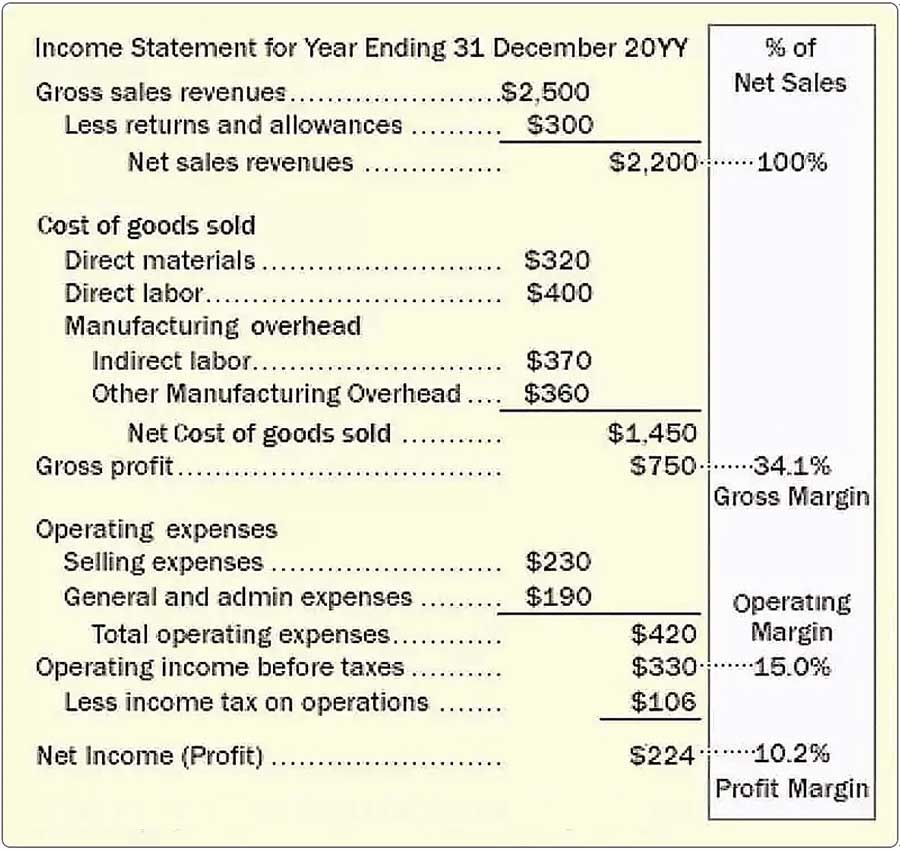

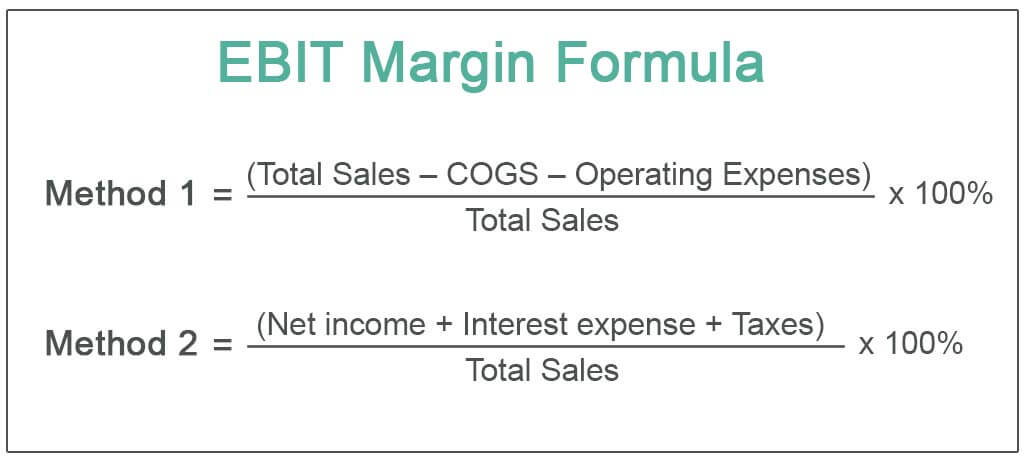

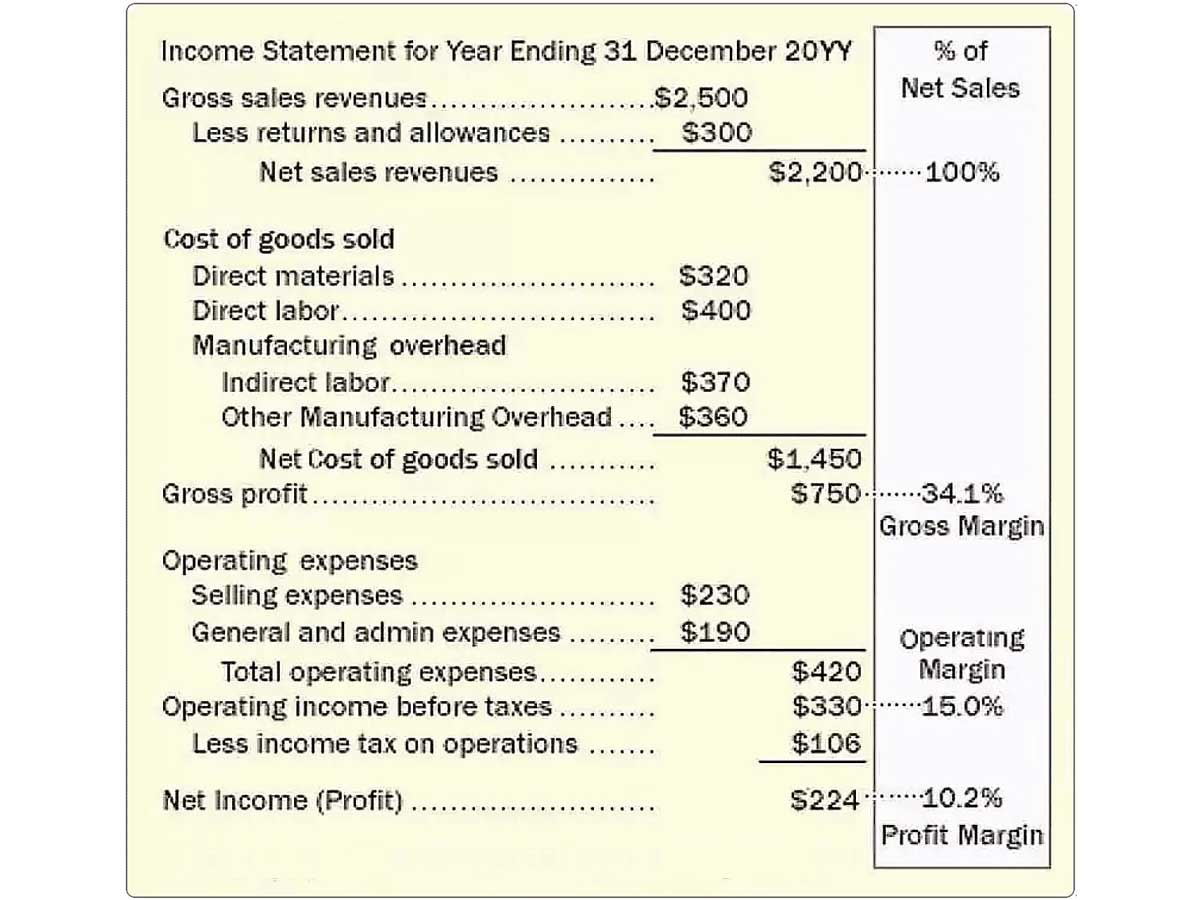

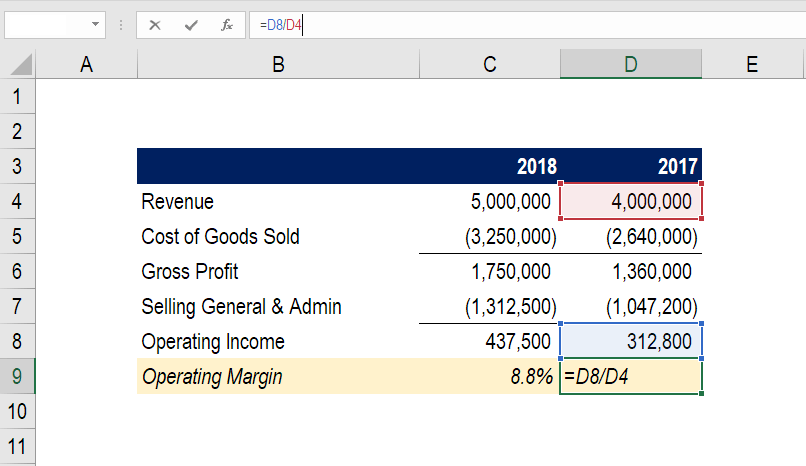

. In financial accounting margins refer to the same difference between revenue and cost in various stages. Operating margin is a profitability ratio measuring revenue after covering operating and non-operating. The Operating Profit Margin.

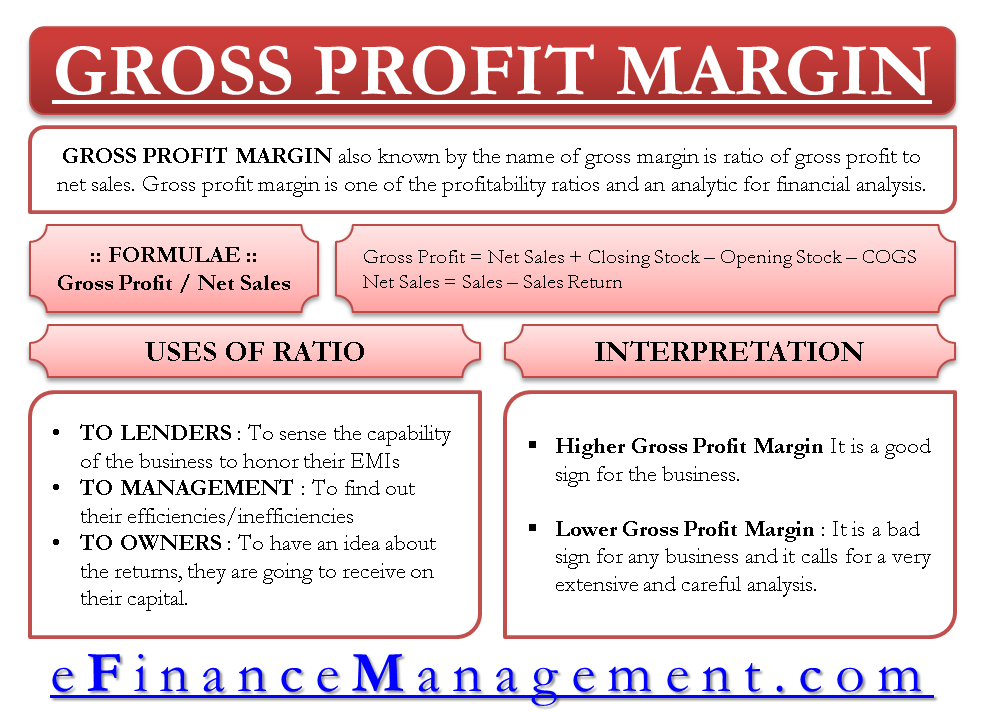

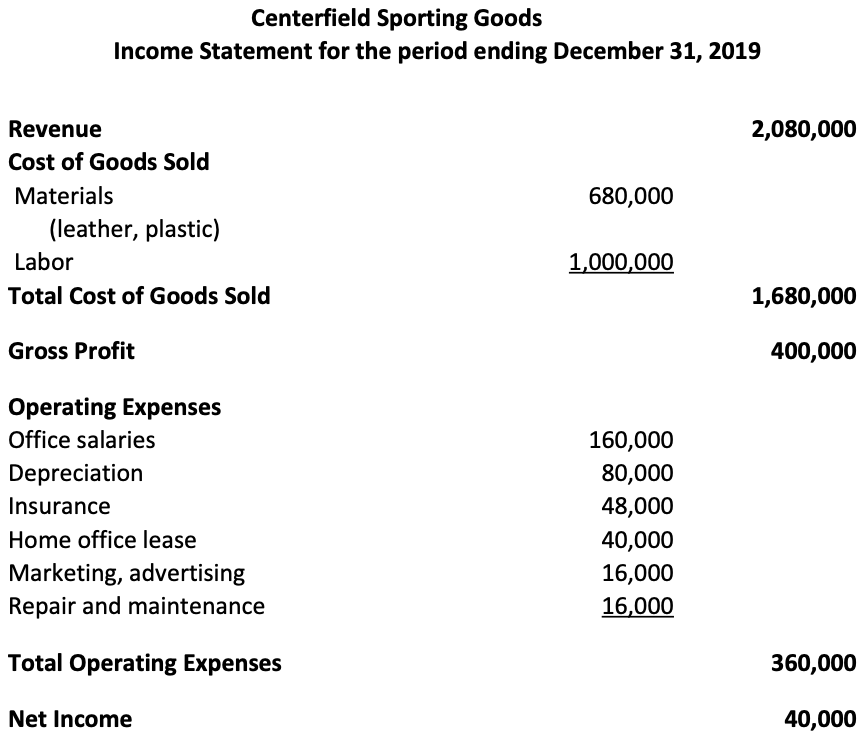

Gross margin often called gross profit is a financial ratio that measures how well a company can control its costs. Profit margin is the percentage of sales that a business retains after all expenses have been deducted. A margin account increases the investors purchasing power but can also expose them to larger losses.

The gross margin formula is calculated by subtracting cost of. Profit margin is calculated with selling price or revenue taken as base times 100. In investing margins refer to situations where an investor buys stocks.

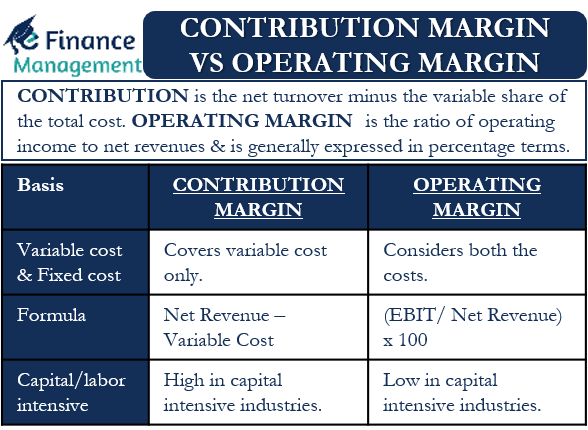

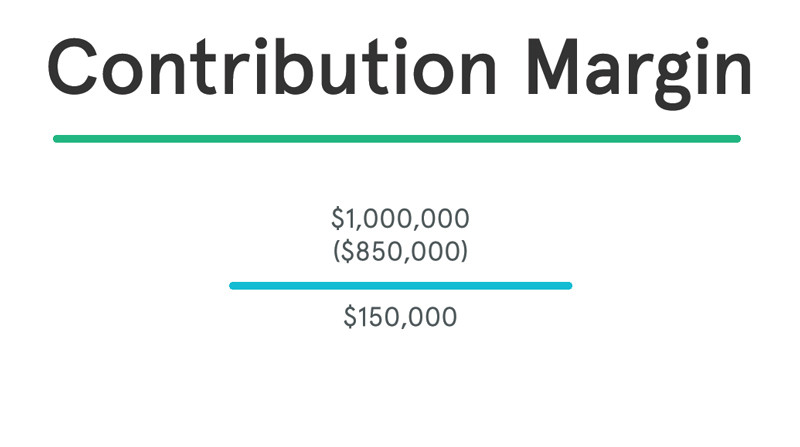

The broker uses the investor deposit and purchased financial products as collateral for the margin debt. Standard margin is used to. Contribution margin is a cost-accounting calculation that measures the profitability of a product or the revenue that is left after covering fixed costs.

Gross margin is the amount or percent before subtracting the selling general and administrative and interest expenses. Margin also known as gross margin is sales minus the cost of goods sold. It is the ratio of net profits to revenues for a company or business segment.

A margin account is a type of brokerage account in which your broker-dealer lends you cash using the account as collateral to purchase securities known as margin. This has been a guide to the Contribution Margin and its meaning. Operating margin is equal to operating income divided by revenue.

Net profit margin is typically expressed as a percentage but can also be represented in decimal. NPM R COGS OE O I T R 1 0 0 or NPM Net income R 1 0 0 where. Difference Between Gross Margin and Profit Margin.

A margin account is a type of brokerage account that allows customers to borrow and invest in stocks and other types of securities. N P M net profit margin R revenue C O G S cost of goods sold O E operating.

:max_bytes(150000):strip_icc()/dotdash_Final_Profit_Margin_Aug_2020-01-853bda68168747d89807dc6ad1053843.jpg)

Profit Margin Defined How To Calculate And Compare

Gross Profit Margin Define Calculation Use And Interpretation Efm

Margins Measure Business Profitability And Reveal Leverage

Gross Profit Margin Formula Meaning Example And Interpretation

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Ebit Margin Formula Excel Examples How To Calculate Ebit Margin

Margins Measure Business Profitability And Reveal Leverage

Operating Margin An Important Measure Of Profitability For A Business

Gross Margin Accounting Play Accounting And Finance Accounting Education Medical School Stuff

What Is The Gross Profit Margin Bdc Ca

Contribution Margin And Operating Margin Meaning Differences Merits

What Is Gross Margin And How To Calculate It Article

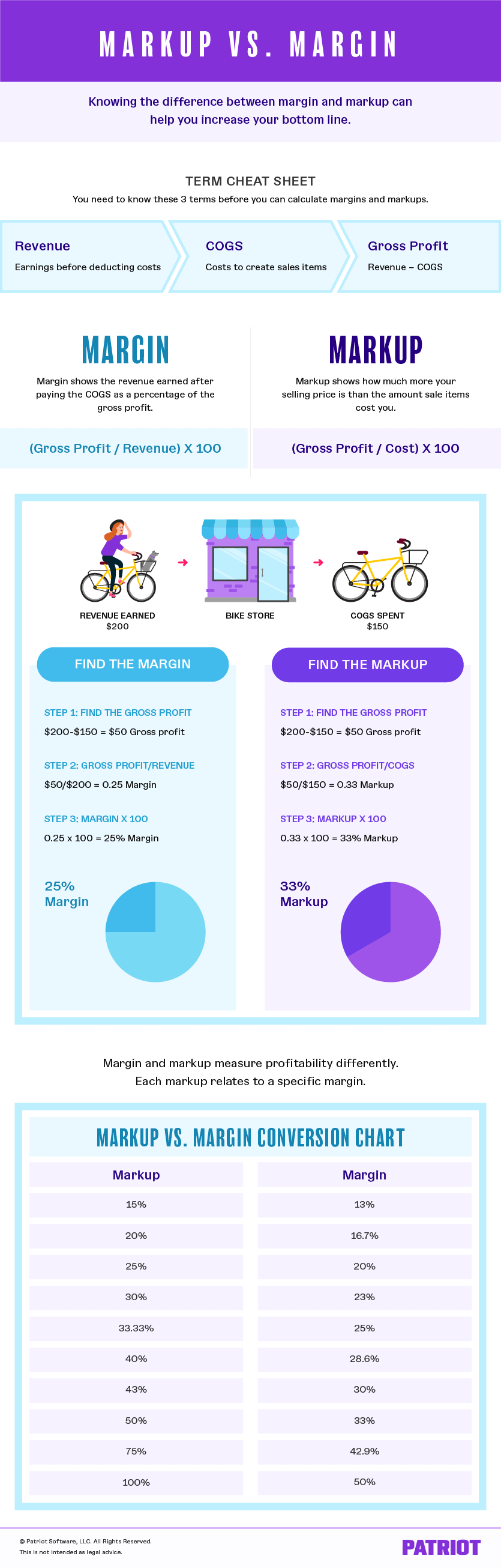

Margin Vs Markup Chart Infographic Calculations Beyond

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Gross Profit Margin Formula Meaning Example And Interpretation

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Contribution Margin Ratio Formula Per Unit Example Calculation